Published papers

“The Elusive Gains from Nationally Oriented Monetary Policy” with Martin Bodenstein and Giancarlo Corsetti, Review of Economic Studies, accepted manuscript.

“Social Distancing and Supply Disruptions in a Pandemic” with Martin Bodenstein and Giancarlo Corsetti, Quantitative Economics, Econometric Society, vol. 13(2), pages 681-721.

“What Drives Bank Performance?” with James Collin Harkrader, Economics Letters, Volume 204, Issue C, 2021.

“Interpreting Shocks to the Relative Price of Investment with a Multi-Sector Model,” with Jinill Kim and Dale Henderson, Journal of Applied Econometrics, vol. 35(1), pages 82-98, 2020.

“Likelihood Evaluation of Models with Occasionally Binding Constraints,” with Pablo Cuba-Borda, Matteo Iacoviello and Molin Zhong, Journal of Applied Econometrics, vol. 34(7), pages 1073-1085, 2019.

"Macroeconomic Effects of Banking Sector Losses Across Structural Models,” with Matteo Iacoviello, Francisco Covas, John Driscoll, Michael Kiley, Mohammad Jahan-Parvar, Albert Queralto Olive, and Jae Sim. International Journal of Central Banking, vol. 15(3), pages 137–204.

“Macroeconomic Policy Games,” with Martin Bodenstein and Joe LaBriola, Journal of Monetary Economics, vol. 101, pages 64–81, 2019.

“Collateral constraints and macroeconomic asymmetries,” with Matteo Iacoviello, Journal of Monetary Economics, vol. 90, pages 28–49, 2017. Slides.

"The Effects of Foreign Shocks when Interest Rates are at Zero” with Martin Bodenstein and Christopher Erceg, Canadian Journal of Economics, vol. 50(3), pages 660–684, 2017.

“OccBin: a toolkit for solving dynamic models with occasionally binding constraints easily,” with Matteo Iacoviello, Journal of Monetary Economics, vol. 70(1), pages 22-38, 2015.

"Modelling Investment-Sector Efficieny Shocks: When Does Disaggregation Matter?” with Dale Henderson and Jinill Kim. International Economic Review, vol. 55(3), pages 891-917, 2014.

"Banks, Sovereign Debt, and the International Transmission of Business Cycles,” with Matteo Iacoviello and Raoul Minetti. NBER International Seminar on Macroeconomics, University of Chicago Press, vol. 9, pages 181 - 213, 2013.

"Oil Shocks and the Zero Bound on Nominal Interest Rates,” with Martin Bodenstein and Christopher Gust. Journal of International Money and Finance, vol. 32(C), pages 941-967, 2013. Codes.

"Monetary Policy Responses to Oil Price Fluctuations,” with Martin Bodenstein and Lutz Kilian. IMF Economic Review, vol. 60(4), pages 470-504, 2012.

"Did Easy Money in the Dollar Bloc Fuel the Oil Price Run-Up?,” with Christopher Erceg and Steven Kamin. International Journal of Central Banking, vol. 7(1), pages 131-160, 2011.

"Oil shocks and external adjustment,” with Martin Bodenstein and Christopher Erceg. Journal of International Economics, Elsevier, vol. 83(2), pages 168-184, 2011.

"International Competition and Inflation: A New Keynesian Perspective,” with Christopher Gust and David Lopez-Salido, American Economic Journal: Macroeconomics. vol. 2(4), pages 247-80, 2010.

"Trade adjustment and the composition of trade,” with Christopher Erceg and Christopher Gust. Journal of Economic Dynamics and Control, vol. 32(8), pages 2622-2650, 2008.

“Optimal Monetary Policy with Distinct Headline and Core Inflation Rates,” with Maritin Bodenstein and Christopher Erceg. Journal of Monetary Economics, vol. 55, pages S18-S33, 2008. Technical appendix. Replication codes.

"On the Application of Automatic Differentiation to the Likelihood Function for Dynamic General Equilibrium Models", in Advances in Automatic Differentiation: Lecture Notes in Computational Science and Engineering, vol. 64. Berlin: Springer, 2008.

"The Inflation Persistence of Staggered Contracts," Journal of Money, Credit and Banking, vol. 38(2), pages 483-494, 2006.

"SIGMA: A New Open Economy Model for Policy Analysis,” with Christopher Erceg and Christopher Gust. International Journal of Central Banking, vol. 2(1), 2006.

"Expansionary Fiscal Shocks and the US Trade Deficit,” with Christopher Erceg and Christopher Gust. International Finance vol. 8(3), pages 363-397, 2005.

"Can Long-Run Restrictions Identify Technology Shocks?,” with Christopher Erceg and Christopher Gust. Journal of the European Economic Association, vol. 3(6), pages 1237-1278, 2005. Replication code for model in Figure 3. Replication code for model in Figure 7.

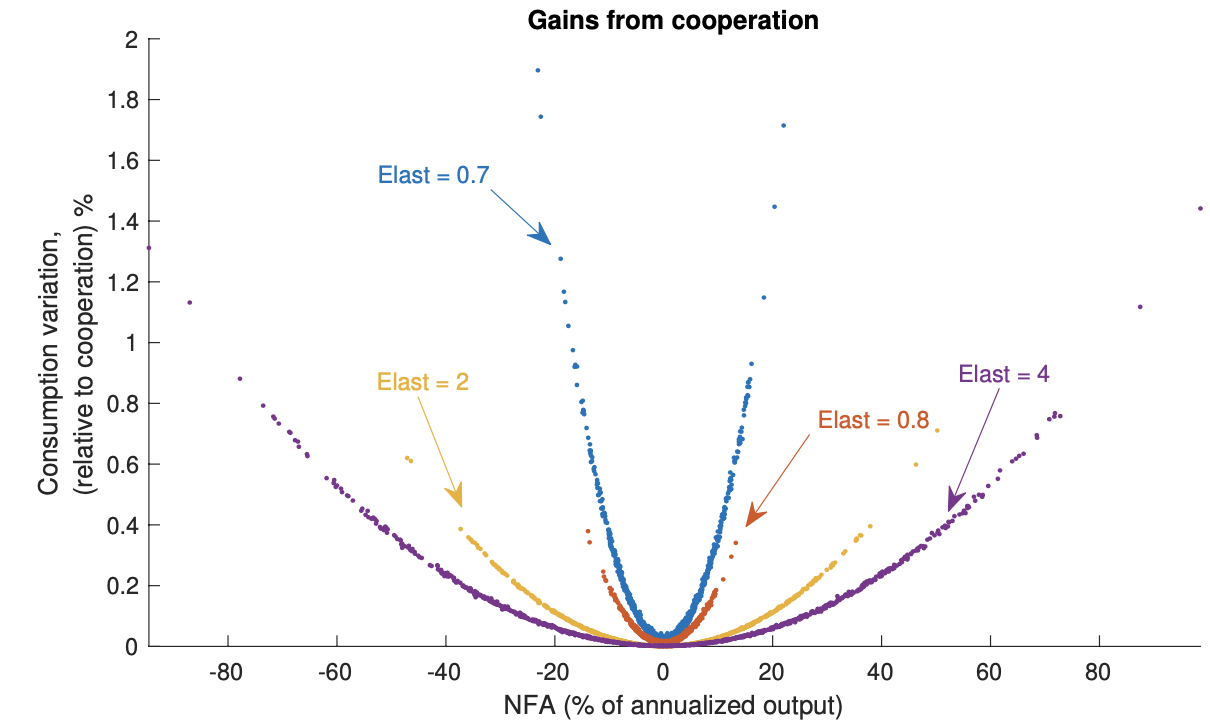

NFA refers to net foreign assets. When international financial markets are incomplete, as modeled by imposing that only non-state-contingent bonds are traded across countries, the gains from cooperation increase in the size of the outstanding NFA.

The Elusive Gains from Nationally Oriented Monetary Policy

With Martin Bodenstein and Giancarlo Corsetti

We show that when assessed conditionally on empirically relevant economic developments, the welfare cost of moving away from regimes of explicit or implicit cooperation between two countries for monetary policy may rise to multiple times the cost of economic fluctuations.

Replication codes

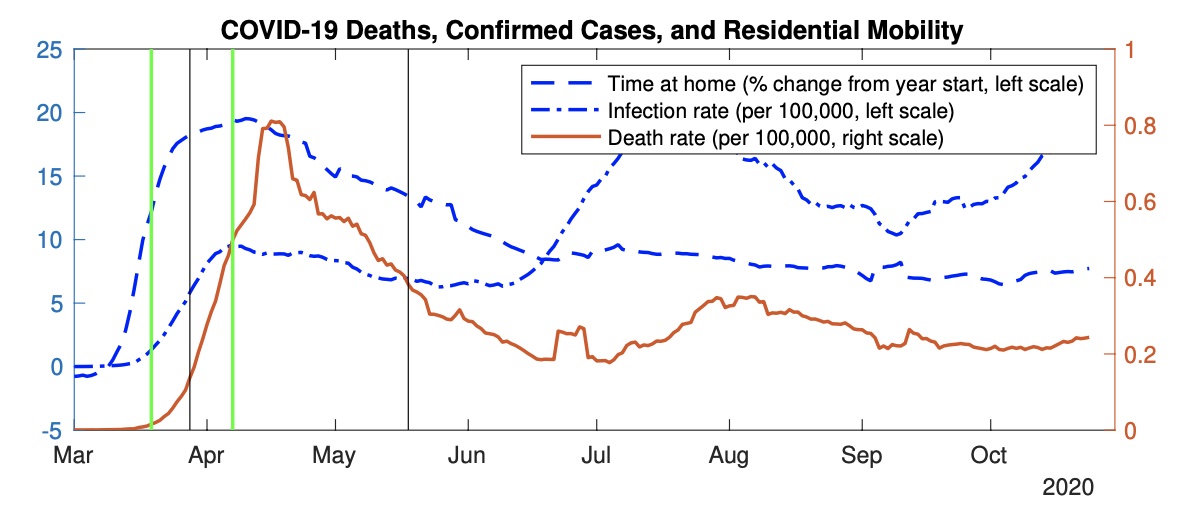

The figure shows COVID-19 infection rates in the United States, death rates, and data on the timing of stay-at-home orders and changes in residential mobility—culled from cell phones, as captured in Google’s mobility reports, and reflecting both trips toward residential addresses and time spent at those addresses.

Social Distancing and Supply Disruptions in a Pandemic

with Martin Bodenstein and Giancarlo Corsetti, Quantitative Economics, 2022

We integrate an epidemiological model, augmented with contact and mobility analyses, with a two-sector macroeconomic model, to assess the economic costs of labor supply disruptions in a pandemic.

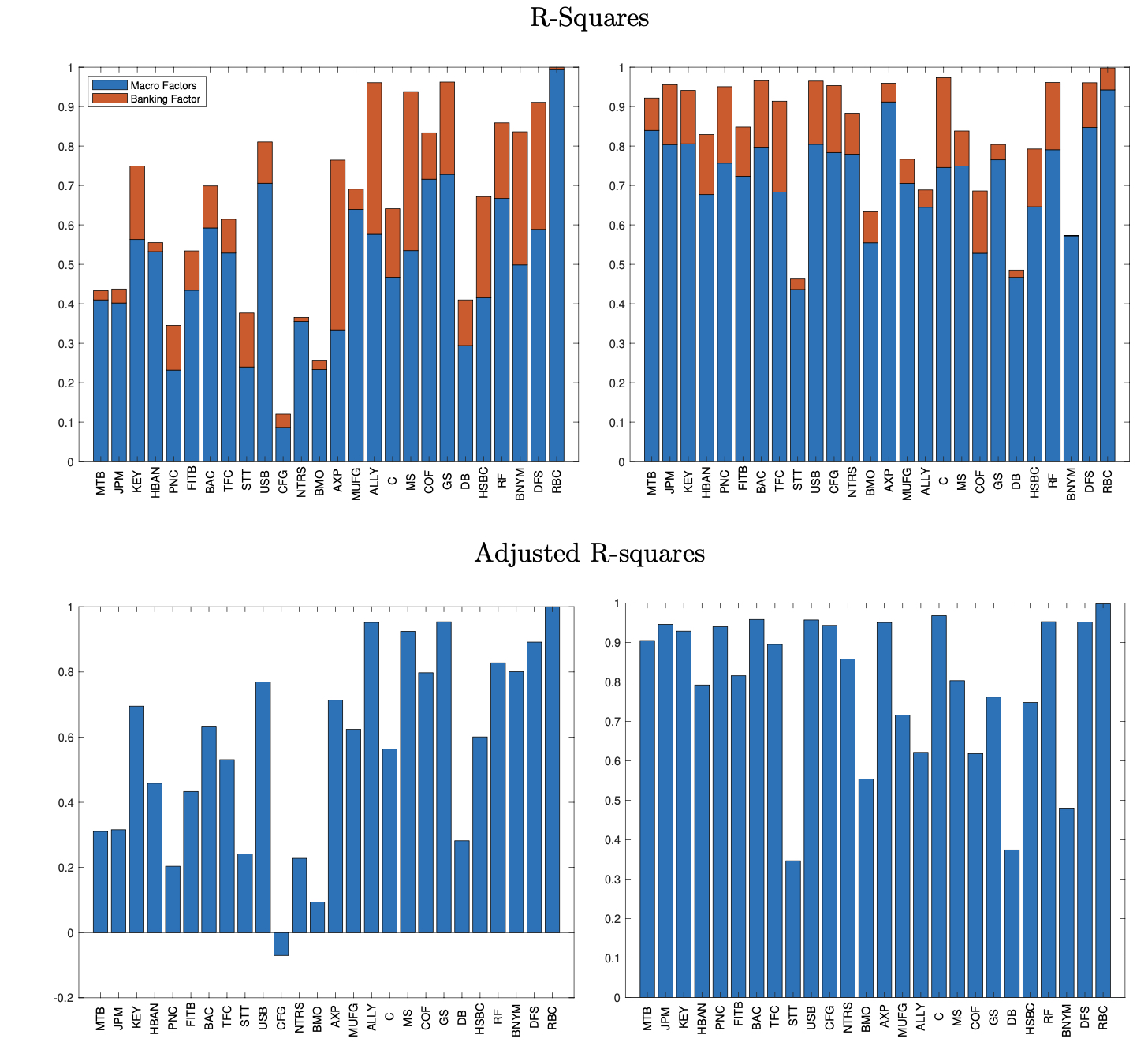

Left, PPNR, and Right, Chargeoffs

What Drives Bank Performance?

With James Harkarader, Economics Letters, 2021

Changes in macroeconomic conditions explain the preponderance of the fluctuations in bank charge-off rates. By contrast, bank-specific drivers are more important for revenues.

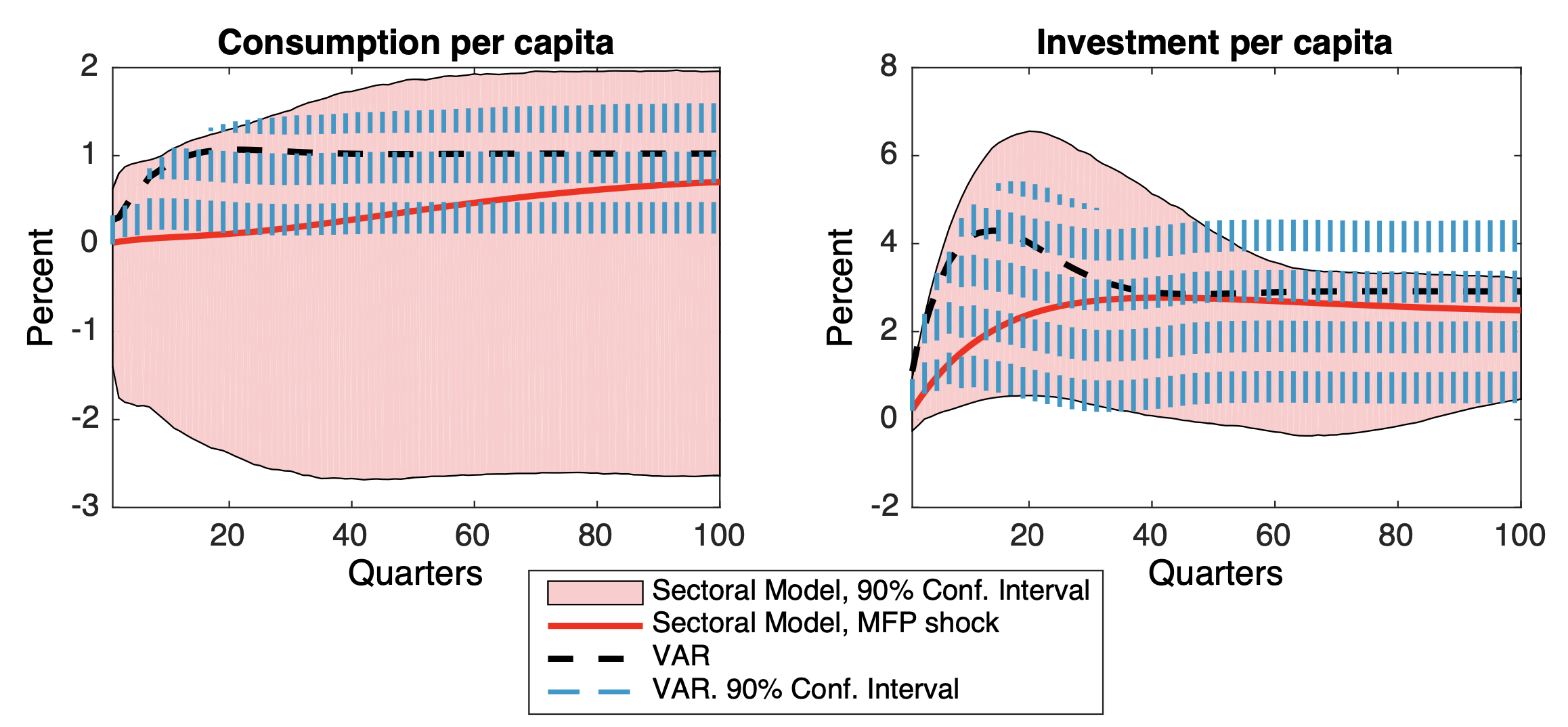

Interpreting Shocks to the Relative Price of Investment with a Multi-Sector Model

with Dale Henderson and Jinill Kim, Quantitative Economics, 2022

Consumption and investment comove over the business cycle in response to shocks that per- manently move the price of investment. The interpretation of these shocks has relied on standard one-sector models or on models with two or more sectors that can be aggregated. We show that the same interpretation can also be motivated with models that cannot be aggregated into a standard one-sector model.

Likelihood Evaluation of Models with Occasionally Binding Constraints

with Pablo Cuba-Borda, Matteo Iacoviello and Molin Zhong, Journal of Applied Econometrics, 2019

We document how solution approximation errors and likelihood misspecification, related to the treatment of measurement errors, can interact and compound each other.

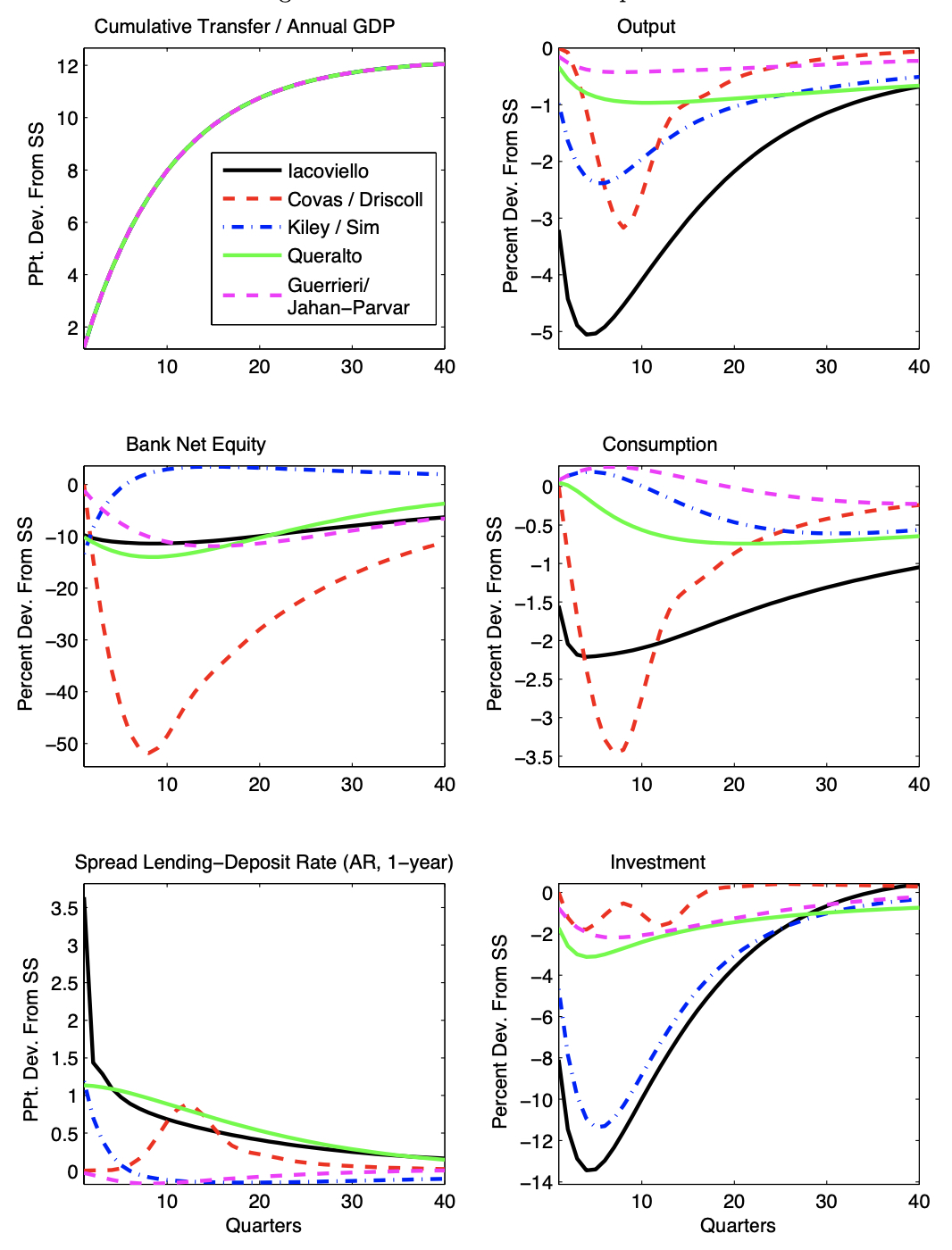

Macroeconomic Effects of Banking Sector Losses Across Structural Models

with Matteo Iacoviello, Francisco Covas, John Driscoll, Michael Kiley, Mohammad Jahan-Parvar, Albert Queralto Olive, and Jae Sim, International Journal of Central Banking, 2019

The macroeconomic effects of capital shortfalls in the financial intermediation sector are compared across five dynamic equilibrium models for policy analysis.

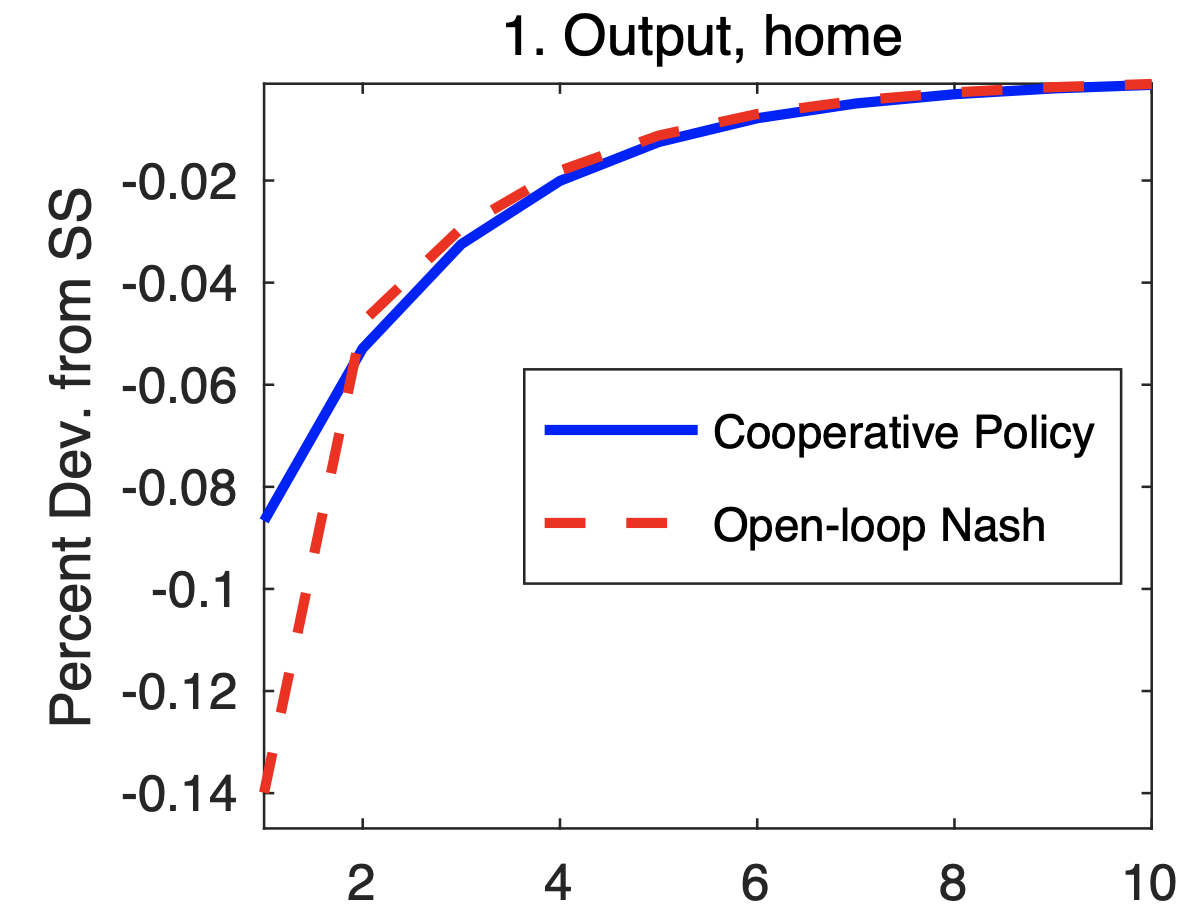

The Effects of Foreign Shocks when Interest Rates are at Zero

with Martin Bodenstein and Joe LaBriola, Journal of Monetary Economics, 2019

We develop a toolbox that characterizes the welfare-maximizing cooperative Ramsey policies under full commitment and open-loop Nash games between policymakers.

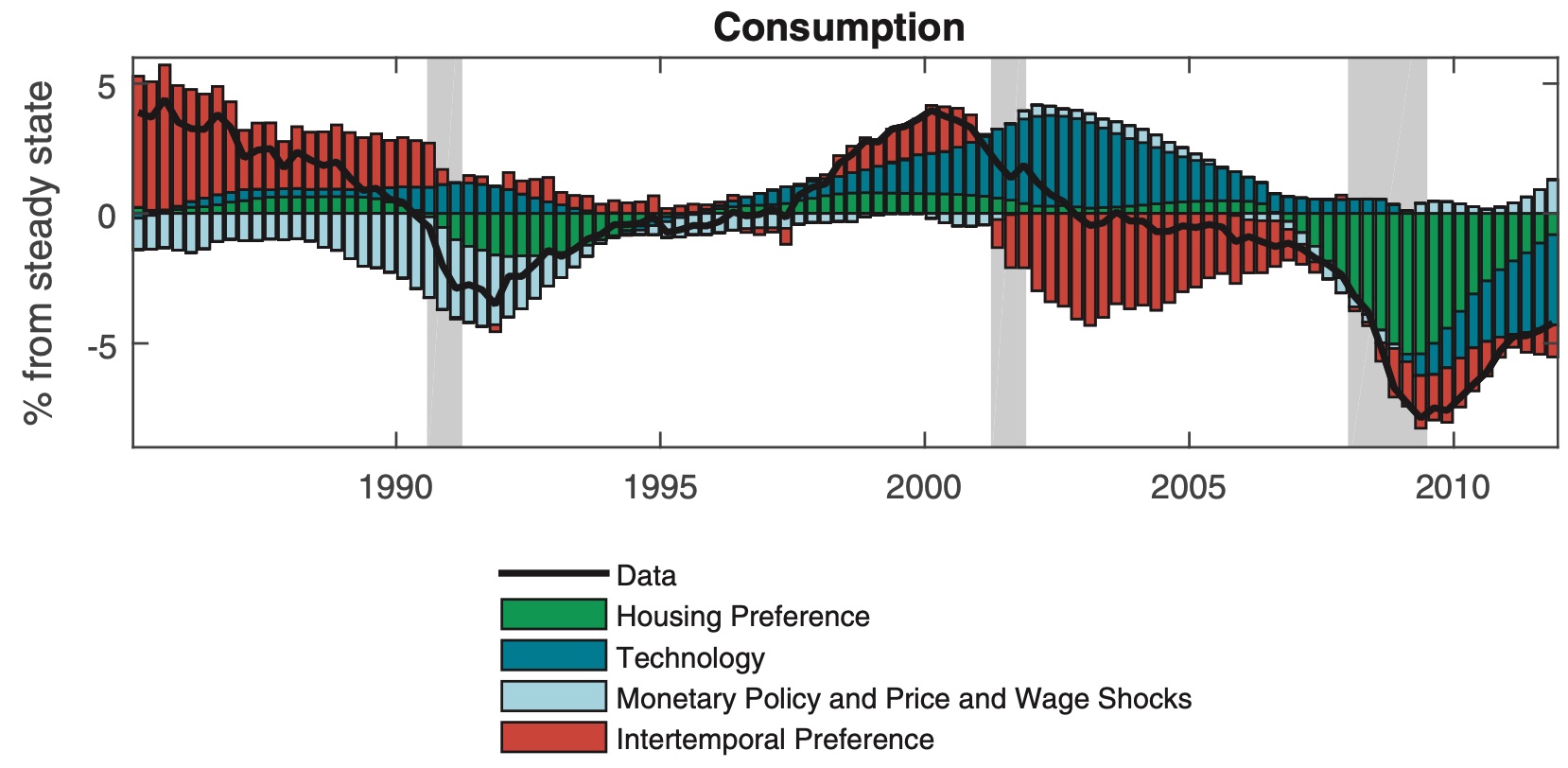

Collateral constraints and macroeconomic asymmetries

with Matteo Iacoviello, Journal of Monetary Economics, 2017

As collateral constraints became slack during the housing boom of 2001–2006, expanding housing wealth made a small contribution to consumption growth. By contrast, the housing collapse that followed tightened the constraints and sharply exacerbated the recession of 2007–2009.

DownloadReplication codes

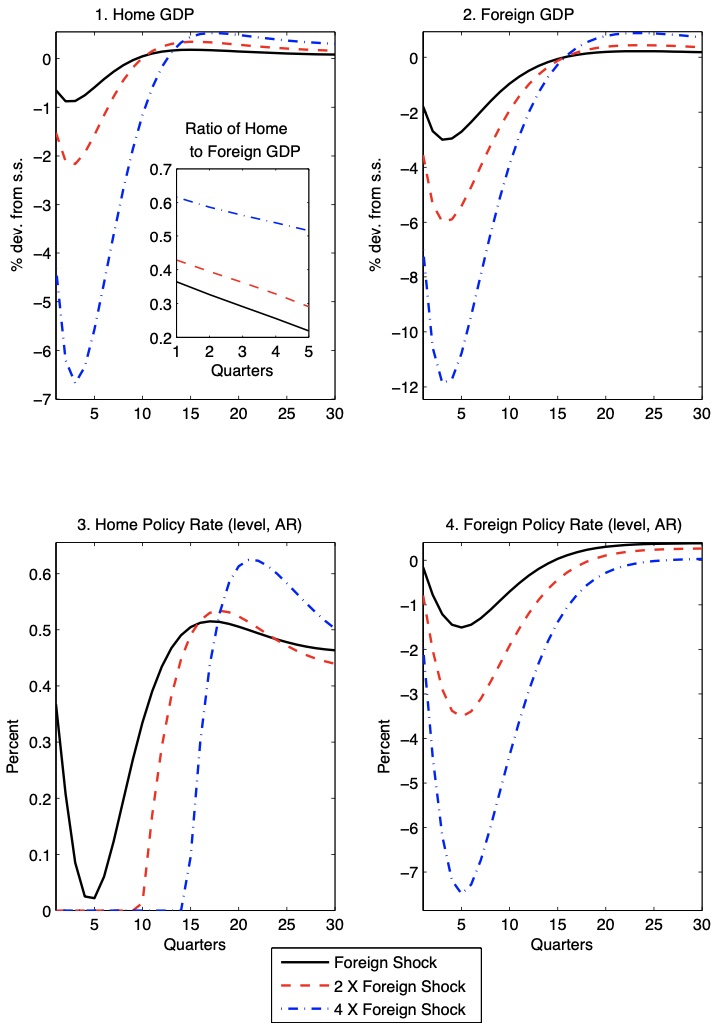

The Effects of Foreign Shocks when Interest Rates are at Zero

with Martin Bodenstein and Christopher Erceg, Canadian Journal of Economics

In a two-country DSGE model, the effects of foreign demand shocks on the home country are greatly amplified if the home economy is constrained by the zero lower bound on policy interest rates. This result applies even to countries that are relatively closed to trade such as the United States.

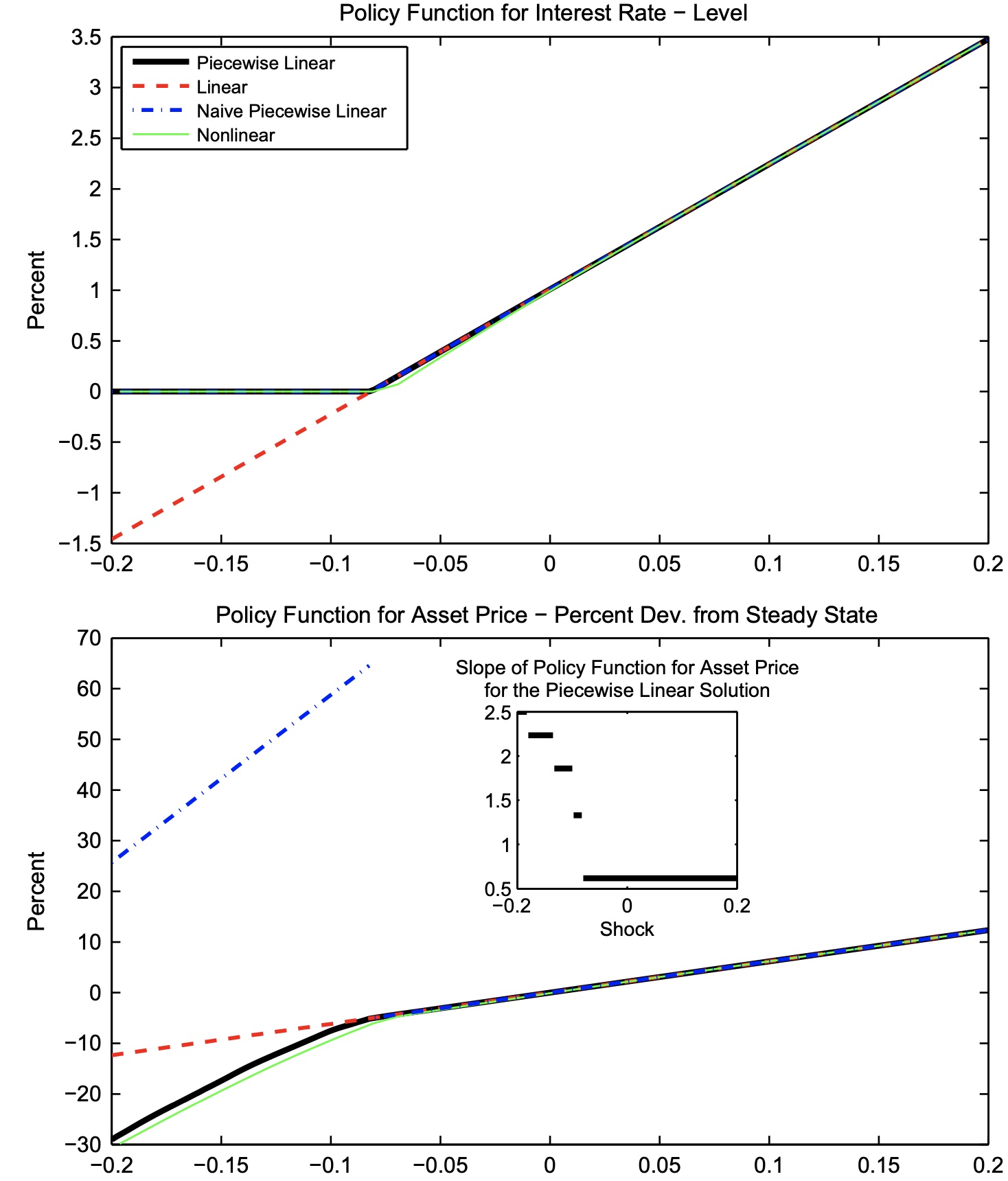

OccBin: a toolkit for solving dynamic models with occasionally binding constraints easily

with Matteo Iacoviello, Journal of Monetary Economics, 2015

The toolkit adapts a first-order perturbation approach and applies it in a piecewise fashion to solve dynamic models with occasionally binding constraints.

Please note that the toolbox works on versions of Dynare through 4.5..

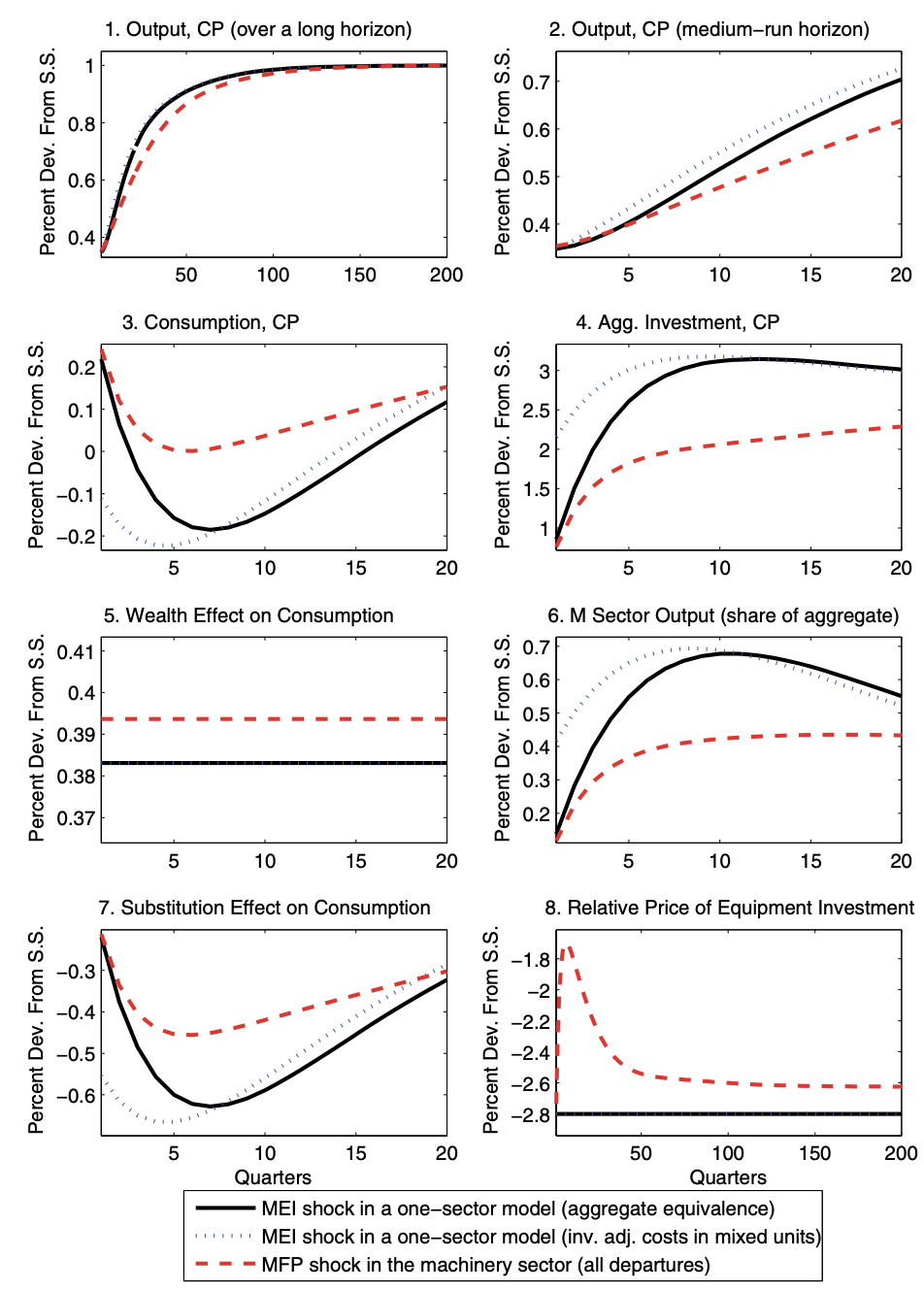

Modelling Investment-Sector Efficieny Shocks: When Does Disaggregation Matter?

with Dale Henderson and Jinill Kim, International Economic Review, 2014

The effects of productivity shocks to an investment-producing sector of our two-sector model differ from those of efficiency shocks to investment in a one-sector model. Notably, expansionary productivity shocks boost consumption in every period, whereas expansionary efficiency shocks cause consumption to fall substantially for many periods.

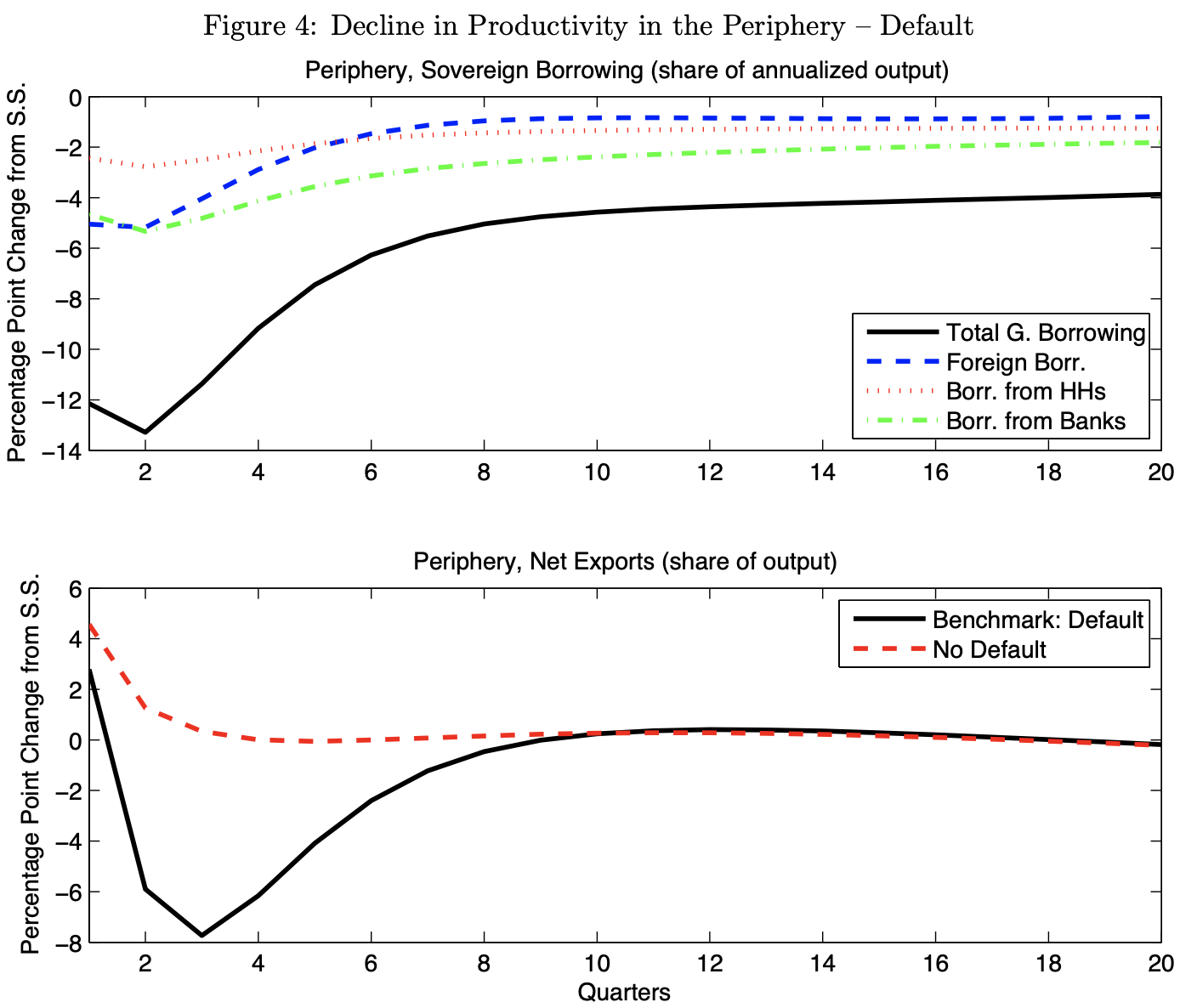

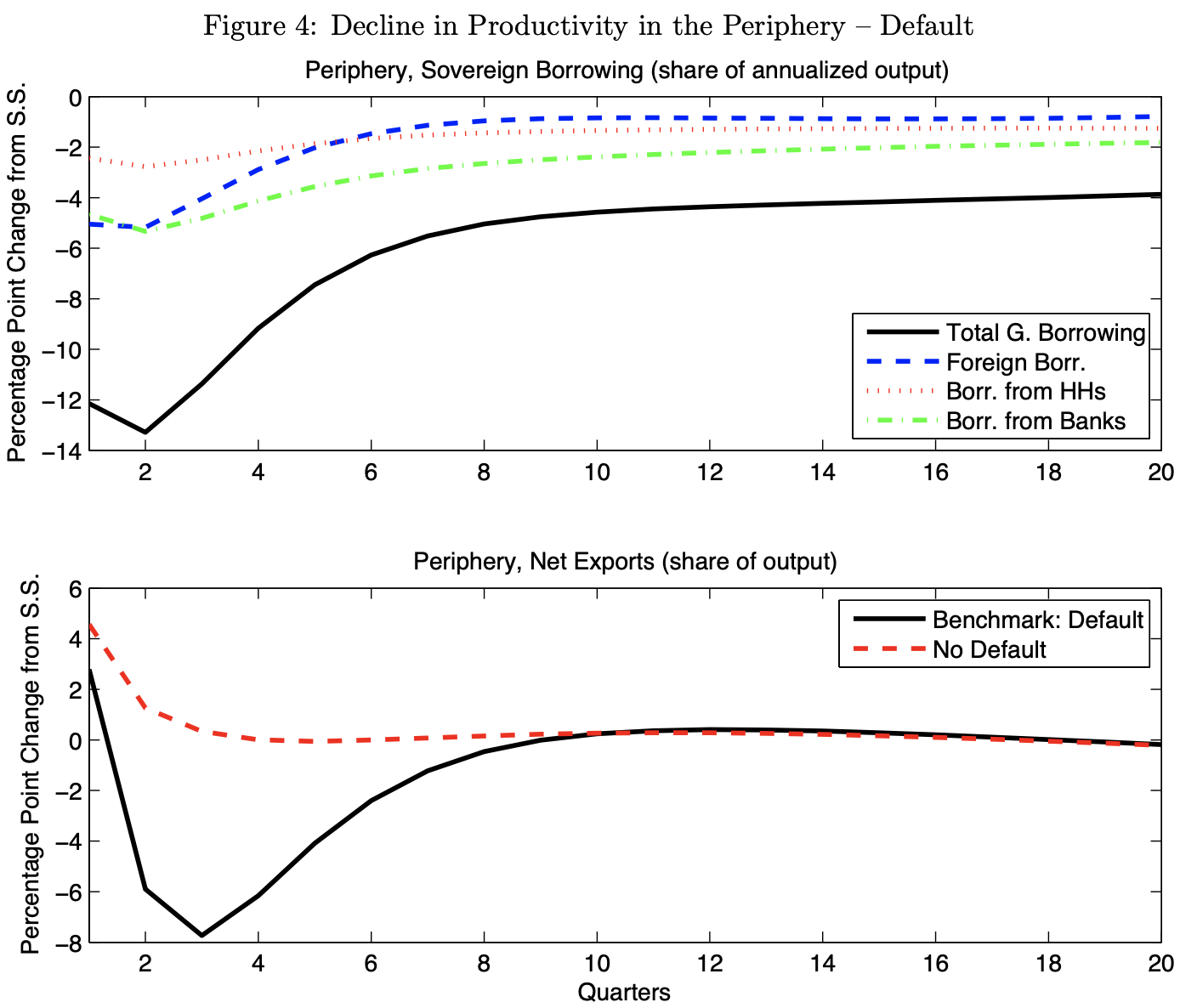

Banks, Sovereign Debt, and the International Transmission of Business Cycles

with Matteo Iacoviello and Raoul Minetti, NBER International Seminar on Macroeconomics, 2013

We posit a two-country economy where capital constrained banks grant loans to firms and invest in bonds issued by the domestic and the foreign government. The model economy is calibrated to data from Europe, with the two countries representing the Periphery (Greece, Italy, Portugal and Spain) and the Core, respectively. Large contractionary shocks in the Periphery trigger sovereign default. We find sizable spillover effects of default from Periphery to the Core through a drop in the volume of credit extended by the banking sector.

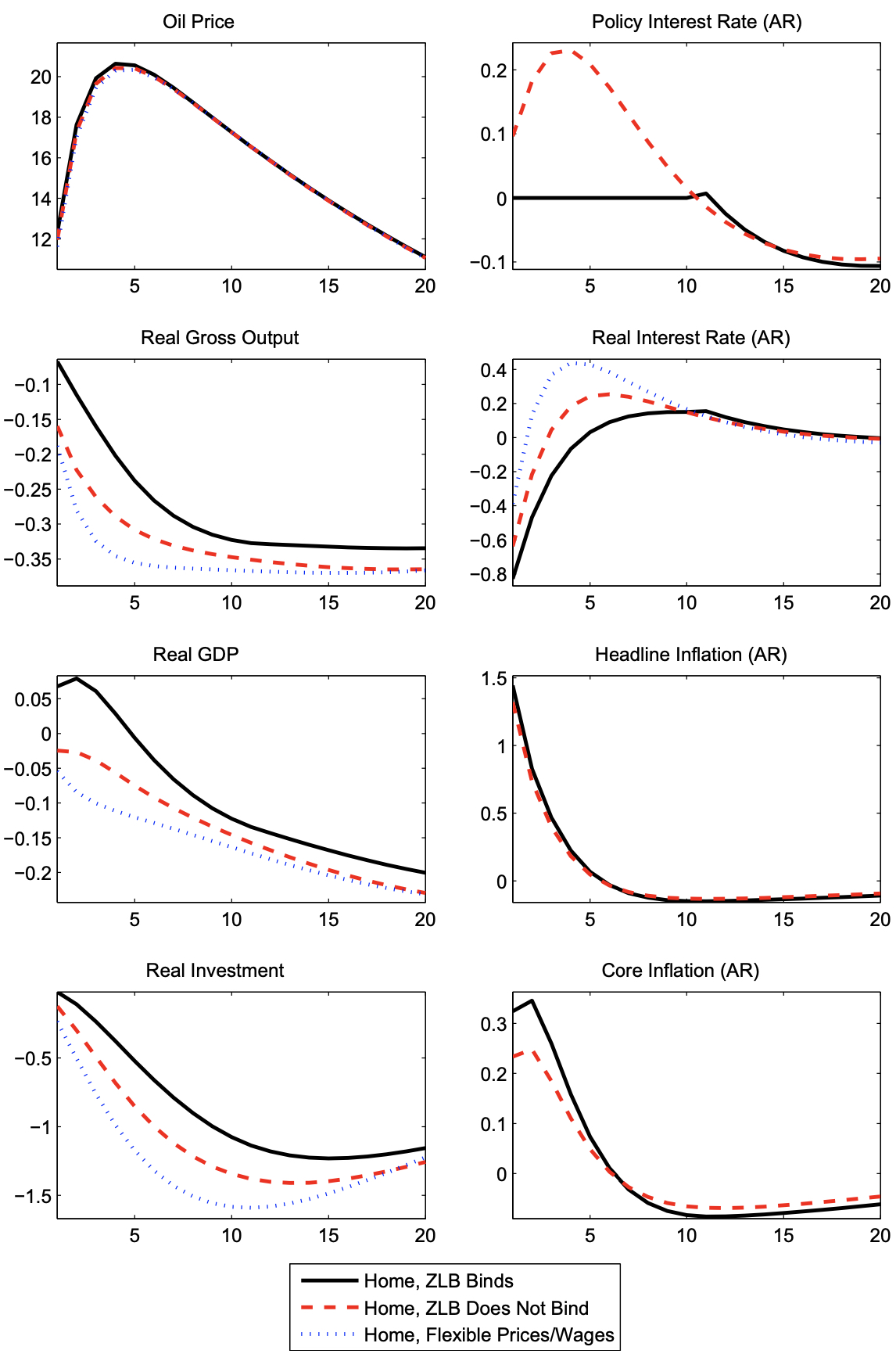

Oil Shocks and the Zero Bound on Nominal Interest Rates

with Martin Bodenstein and Christopher Gust. Journal of International Money and Finance, 2013

The burst of inflation from an oil price increase lowers real interest rates at the ZLB and stimulates the interest-sensitive component of GDP, off- setting the usual contractionary effects.

Optimal Monetary Policy with Distinct Headline and Core Inflation Rates

with Maritin Bodenstein and Christopher Erceg, Journal of Monetary Economics, 2008

We posit a two-country economy where capital constrained banks grant loans to firms and invest in bonds issued by the domestic and the foreign government. The model economy is calibrated to data from Europe, with the two countries representing the Periphery (Greece, Italy, Portugal and Spain) and the Core, respectively. Large contractionary shocks in the Periphery trigger sovereign default. We find sizable spillover effects of default from Periphery to the Core through a drop in the volume of credit extended by the banking sector.